closed end fund liquidity risk

This can result in losses if an investor. Liquidity risk management program rule1 demand for asset classes that are not suitable for open-end funds which must provide for daily redemption.

What Is The Difference Between Closed And Open Ended Funds Quora

Ad Mutual Fund Trading Made Simple.

. The results thus support the liquidity explanation for the closed-end fund discount. A closed-end fund is a type of mutual fund that issues a fixed number of shares through a single initial public offering IPO to raise capital for its initial investments. And a weak market for traditional.

The value of a CEF can decrease due to movements in the overall financial markets. The Liquidity Rule defines liquidity risk as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining. Funds are required to assess manage and periodically review their liquidity risk based on specified factors.

Funds ETFs but not including money market funds to establish a liquidity risk management program. Ad HSBC liquidity management offers self-funding and investment solutions. Compared to ETFS closed-end funds have two main advantages when investing in digital assets.

Rule 22e-4 also requires principal underwriters and depositors of unit investment. Just like open-ended funds closed-end funds are subject to market movements and volatility. Meanwhile a newly adopted liquidity risk management program rule by the SEC limits open-end funds to investing only up to 15 of their net asset value in the illiquid investments.

Like it or not digital assets such as bitcoin. In July 2016 the HK SFC published a circular providing. In October 2016 the US SEC adopted new rules designed to promote effective liquidity risk management for open -end funds.

Liquidity risk is defined as the risk that a fund could not meet. 10 Best Closed-End Funds. Closed-end funds that return capital can carry a higher level of risk because the fund is eroding the asset base it has to generate income to pay distributions.

Closed-end funds CEFs can be one solution with yields averaging 673. HSBCs Liquidity Solutions Are Tailored To Be Compliant With Local Market Regulations. Open Fund an Account Today at TD Ameritrade.

Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity. CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration risk and discount risk. A closed end fund is just like a mutual fund or an exchange traded fund in that a manager buys and sells investments and investors can buy an ownership stake in the whole.

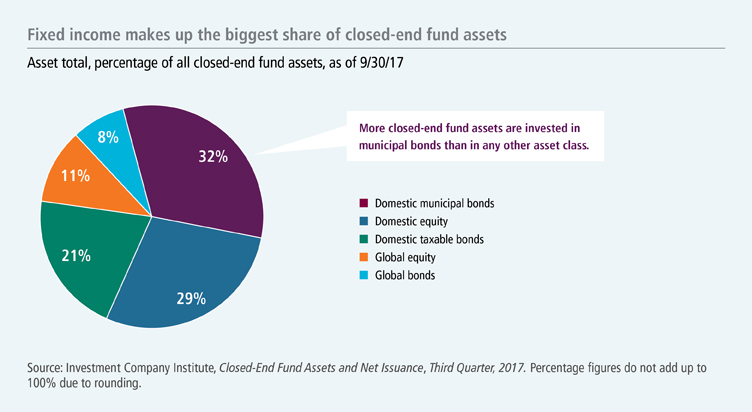

Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. Liquidity management and valuation. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF.

Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says.

Pdf A Liquidity Based Theory Of Closed End Funds

Understanding Interval Funds Griffin Capital

A Closer Look At Closed End Funds Fundx Insights

Finding Opportunities In The Closed End Fund Market

Guide To Closed End Funds Money For The Rest Of Us

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Closer Look At Closed End Funds Fundx Insights

Closed End Fund Fs Investments

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Investing In Closed End Funds Nuveen

A Complete Guide To Investment Vehicles Money For The Rest Of Us

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Pdf A Liquidity Based Theory Of Closed End Funds

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer